Queue Management System: Why Customers Hate Waiting

Waiting in bank branches is no longer just an inconvenience, it’s a customer experience risk. This blog explains why long queues hurt retail banks, how waiting impacts trust and satisfaction, and how modern queue management systems help banks create smoother, calmer, and more efficient branch experiences.

Table of Content

Try Vizitor for Free!

Published on: Thu, Jan 15, 2026

Read in 6 minutes

Retail banking is changing faster than ever, but not in the way many people expect.

While digital banking continues to grow, physical branches are far from obsolete. In fact, in 2026, branches play a more critical role than before, as trust centers, advisory hubs, and relationship builders. What has changed is how customers experience these spaces.

Today’s banking customers expect the same speed, clarity, and convenience inside a branch that they experience online. When that expectation isn’t met, long wait times, unclear processes, and crowded lobbies quickly become dealbreakers.

This blog explores the key challenges facing retail banks, the opportunities hidden within them, and how modern visitor and queue management is shaping the future of in-branch banking.

The modern retail banking challenge: Experience meets expectation

Banking customers no longer compare one bank branch to another.

They compare their bank visit to every fast, seamless digital experience they’ve had that day.

This shift has created several challenges for retail banks:

- Increased walk-in traffic during peak hours

- Limited visibility into customer flow and wait times

- Overloaded front desks and branch staff

- Frustrated customers who feel their time is being wasted

In many branches, these issues aren’t caused by staff shortages or lack of effort. They’re caused by outdated, manual processes that can’t keep up with modern expectations.

Why waiting has become a serious banking risk

In 2026, waiting is no longer seen as a neutral inconvenience.

It’s perceived as poor service.

When customers walk into a branch and see a long queue:

- They feel uncertain about how long the visit will take

- They lose confidence in the bank’s efficiency

- They become less receptive during their interaction

For some, the result is simple, they leave.

For others, the damage is subtle but lasting: lower satisfaction, weaker trust, and negative reviews that influence future customers.

The operational pressure behind the scenes

Branch staff experience the same friction from the other side.

During busy periods:

- Employees face constant interruptions

- Service quality drops as staff rush to keep up

- Stress levels rise, increasing the risk of errors

This creates a cycle where customer frustration increases staff pressure, and staff pressure further degrades customer experience.

Breaking this cycle requires more than adding people to the front desk. It requires rethinking how customer flow is managed.

Opportunity 1: Turning physical queues into digital flow

One of the biggest opportunities for retail banks lies in eliminating physical queues altogether.

Modern queue and visitor management allows customers to:

- Check in digitally when they arrive

- Join a virtual queue instead of standing in line

- Wait comfortably while receiving live updates on their turn

By removing the physical line, banks immediately reduce visible congestion and stress inside the branch.

The experience feels calmer, more professional, and more respectful of customers’ time.

Opportunity 2: Bringing transparency to wait times

Uncertainty is often more frustrating than the wait itself.

When customers don’t know:

- How long they’ll be waiting

- Whether they’ve been noticed

- If someone else will be served first

Anxiety builds quickly.

With real-time notifications and queue position updates, banks can give customers clarity and control. When people know where they stand, they relax. They trust the process.

Opportunity 3: Using data to run smarter branches

Every customer interaction tells a story.

Modern visitor and queue systems capture valuable insights, such as:

- Peak days and hours

- Average service times

- Bottlenecks within the branch

- Staffing mismatches

This data allows branch managers to move from reactive problem-solving to proactive planning, adjusting staffing and layouts before issues arise.

Opportunity 4: Elevating the first impression

For many customers, the branch visit begins before they speak to anyone.

The check-in experience sets the tone.

A clean, organized lobby with digital check-in and guided flow signals:

- Professionalism

- Security

- Respect for customer time

This first impression directly influences how customers perceive the rest of their interaction, even the financial advice they receive.

How modern banks are rethinking branch experience

Forward-looking banks are no longer asking:

“How do we process customers faster?”

They’re asking:

“How do we make waiting feel invisible?”

By focusing on flow instead of lines, banks are transforming branches into calmer, more efficient spaces where both customers and staff can perform better.

The role of Vizitor in modern retail banking

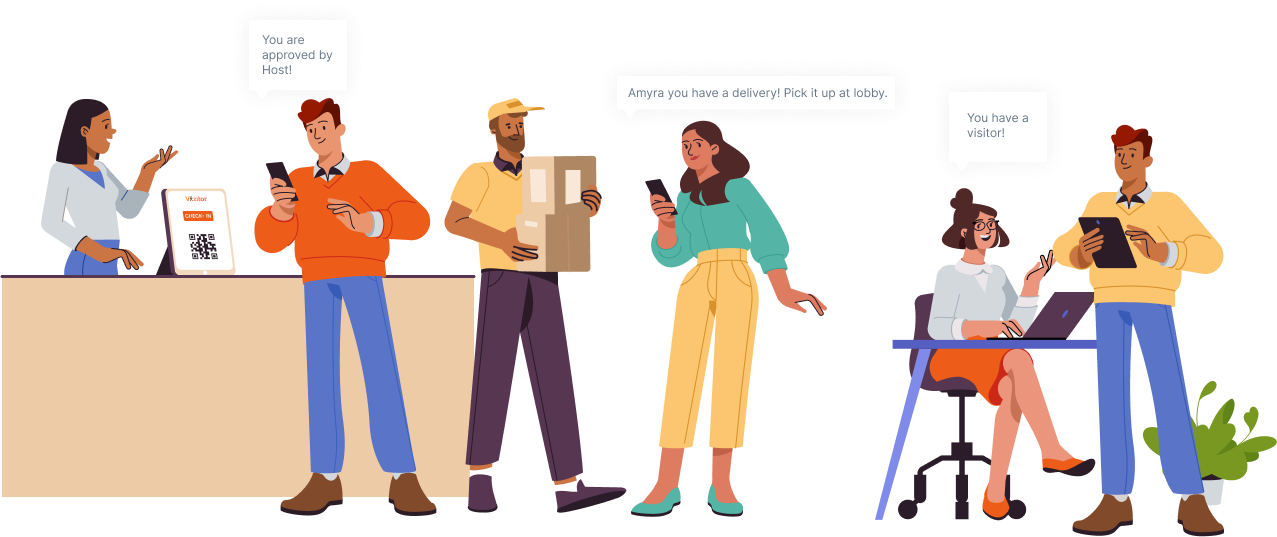

Vizitor helps retail banks replace manual check-ins and physical queues with a smart, digital visitor flow.

With Vizitor, banks can:

- Enable digital check-in and virtual queuing

- Provide real-time updates to customers

- Reduce lobby congestion and visible wait stress

- Gain insights into branch traffic and service patterns

- Improve staff efficiency without increasing headcount

Whether managing daily walk-ins, appointment-based visits, or peak-hour surges, Vizitor helps branches stay organized, calm, and customer-friendly.

What the future of retail banking looks like

In 2026 and beyond, successful retail banks will be defined not just by products or rates, but by how customers feel during every interaction.

Branches that respect time, remove friction, and guide customers smoothly will build stronger relationships and long-term loyalty.

The future of retail banking isn’t just digital.

It’s thoughtfully designed, experience-driven, and operationally smart.

Final thought

Retail banking is no longer just about transactions.

It’s about trust, efficiency, and experience.

When banks remove the stress of waiting, they don’t just improve service, they strengthen relationships.

And in an industry built on trust, that makes all the difference.

Ready to modernize your branch experience?

See how Vizitor helps retail banks turn queues into smooth, digital flow and create calmer, more efficient branches.

FAQs

1. What is a queue management system in banking?

A queue management system in banking helps manage customer flow inside branches by replacing physical lines with digital or virtual queues. Customers can check in digitally, receive updates on wait times, and be served in an organized, transparent order.

2. How do banks reduce customer waiting time in branches?

Banks reduce waiting time by using virtual queue management, digital check-in kiosks, and real-time notifications. These systems help balance customer flow, prioritize services, and reduce visible congestion in branch lobbies.

3. Why is queue management important for retail banks?

Queue management is important because long waits negatively impact customer satisfaction, trust, and retention. Poor waiting experiences often lead to walk-outs, complaints, and negative reviews, even if the banking service itself is good.

4. Can queue management systems improve customer experience in banks?

Yes. Queue management systems improve customer experience by providing transparency, fairness, and flexibility. Customers know their position in line, estimated wait time, and can wait comfortably instead of standing in crowded lobbies.

5. How does virtual queuing work in bank branches?

With virtual queuing, customers join a digital queue using a kiosk or QR code. They receive SMS or app notifications about their turn and can wait anywhere until they are called, reducing lobby crowding and stress.

6. What are the benefits of digital check-in for banks?

Digital check-in helps banks streamline front-desk operations, reduce manual errors, improve security, and capture visitor data. It also creates a modern first impression and reduces pressure on branch staff during peak hours.

7. How does queue management help bank staff?

Queue management systems reduce staff stress by organizing customer flow, preventing sudden surges, and providing visibility into workload. This allows employees to focus on service quality rather than crowd control.

8. Is queue management useful for appointment-based banking?

Yes, Queue management systems work alongside appointment scheduling by managing walk-ins, late arrivals, and priority customers, ensuring smooth flow without disrupting scheduled services

[An overview of how queue management systems help retail banks reduce customer waiting time, improve branch experience, and manage walk-in traffic using virtual queues and digital check-in.]